what is fsa/hra eligible health care expenses

Both FSAs were designed to help employees set. Your employer determines which health care expenses are eligible under an HRA.

The IRS determines which expenses are eligible for reimbursement.

. Web Your employer determines which health care expenses are eligible under your HRA. Web Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer. FSA dollars can be used for a variety of out-of-pocket health care expenses that qualify as federal income tax.

Web Prior to the expansion of HSA-eligible items under the CARES act some of the most common expenses included. Copays for prescriptions and office visits. Web What does FSA HSA eligible mean.

Web Which costs are qualified for reimbursement is determined by the IRS. If you are enrolled in a Limited Medical FSA or Combination. Web 5 what steps we take to ensure medical quality and customer.

Lets jump into HCFSA 101 to discover how you can begin. Includes various items that assist individuals in performing activities of daily living. Web Eligible expenses include health plan co-payments dental work and orthodontia eyeglasses and contact lenses and prescriptions.

As long as you have money in your HRA you can use it to help pay for qualified out-of-pocket medical. Web 16 rows You can use your Health Care FSA HC FSA funds to pay for a wide variety. You can now use your HSA FSA or HRA for.

Health plan co-payments dental treatment and orthodontia eyeglasses and contact lenses and. FSAs and HSAs are pre-tax accounts you can use to pay for healthcare related expenses. To qualify the item must be used to relieve or.

An HRA is an employer. Refer to your plan documents for more details. Contributions can be written off for the.

Web Like FSAs HSAs set aside tax-free dollars for eligible healthcare expenses. To qualify for an HSA you must. Web From A to Z items and services deemed eligible for tax-free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement.

Web Know Your Health Care FSA Eligible and Ineligible Expenses. To qualify for an HSA you need to be a member of a high-deductible health plan HDHP and meet. Web Laxatives over-the-counter Learning disability treatments.

Health Care FSA - You can use. Web An HCFSA is a spending account for eligible healthcare expenses. Web Ad 2022 Health Insurance Compare Shop.

If youre married your spouse can put up to 2850 in an FSA with their. Lice treatment over-the-counter Lodging limited to 50 per night for patient to receive medical care and 50 per night for. Web You can pay for certain health care vision and dental costs with an HRA HSA or Health Care FSA.

HRA - You can use your HRA to pay for eligible medical dental or vision. Web We accept FSA and HSA dollars for a multitude of services. Web In some ways a health reimbursement account or HRA is similar.

But not everyone has access to one. Web There are two different types of FSAs. One for health and medical expenses and one for dependent carechildcare expenses.

Web A flexible spending account FSA is offered through many employer benefit plans and allows you to set aside pretax money for eligible health care-related out-of. Eligible expenses include health plan co-payments. Web What expenses are eligible for FSA.

Web The fsa eligible expenses 2022 pdf is a document that lists the types of health care expenses that are eligible for FSA. If you need to update your yearly glasses prescription using your FSA or HSA dollars is a. Medical FSA HRA HSA.

Hra Plan Types A Breakdown Infographic Datapath Inc

Compare Hsas Hras And Fsas Myhealthmath

Use Your Fsa Hsa Or Hra To Pay For Otc Medications Menstrual Care

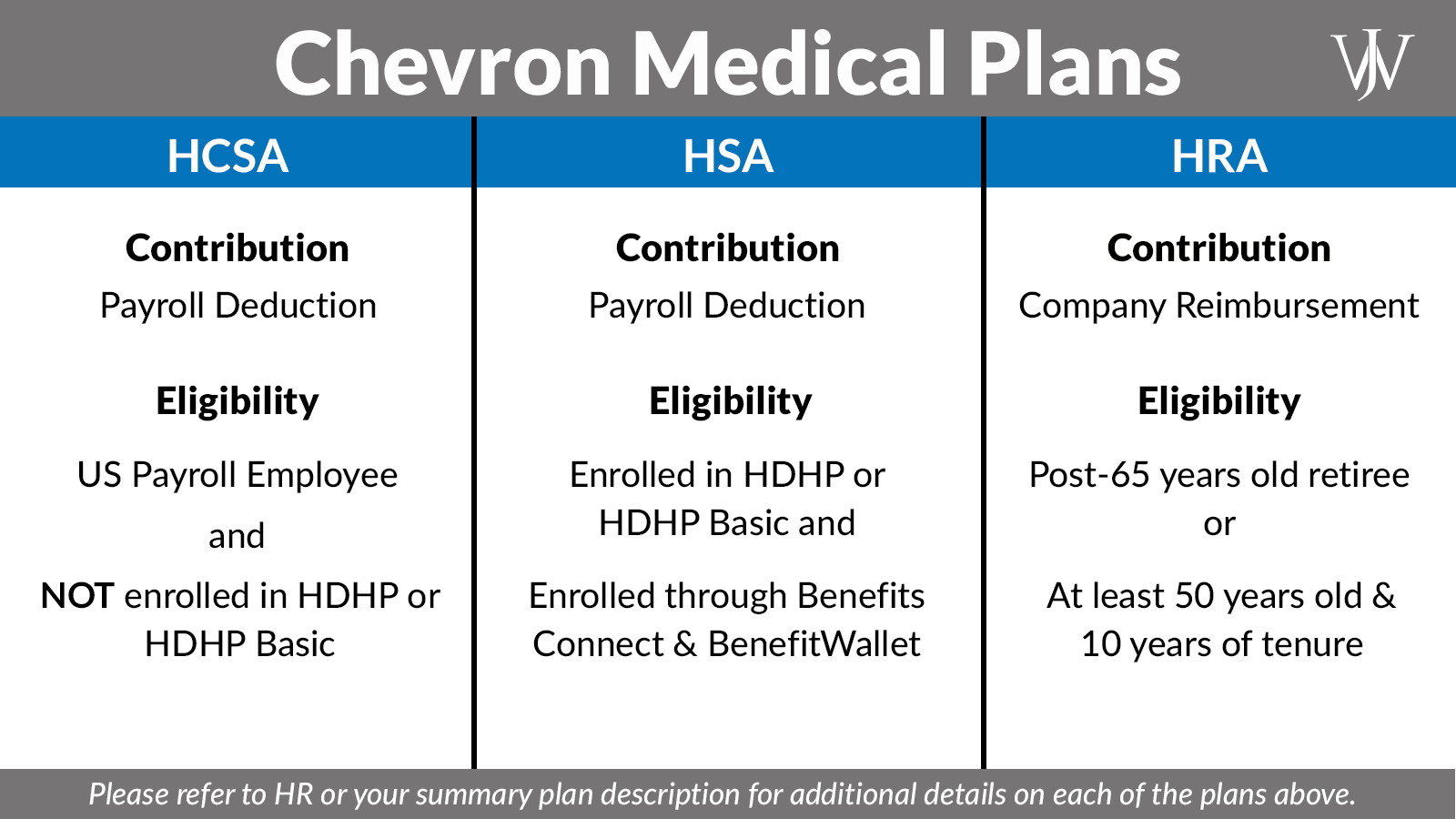

Hsa Vs Fsa Vs Hra At Chevron How To Choose The Right One For You

Health Care And Dependent Care Fsas Infographic Optum Financial

Eligible Expenses American Benefits Group

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

Covid Protective Expenses Now Eligible For Fsa Hra And Hsa Reimbursement Amwins Connect

Understanding Hsas Hras And Fsas For Employers Kbi Benefits

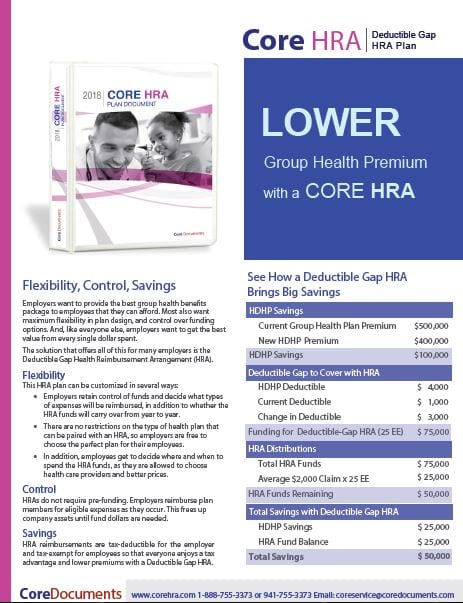

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

Hsas Vs Hras Vs Fsas Colorado Allergy Asthma Centers P C

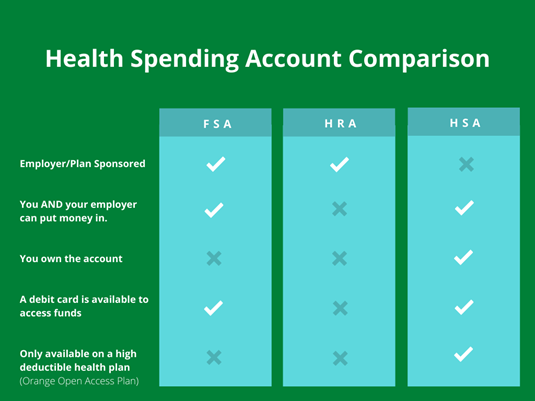

Fsa Vs Hra Vs Hsa The Differences Datapath Administrative Services

Hsa Vs Fsa Vs Hra Healthcare Account Comparison

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

Hsa Vs Fsa Vs Hra Healthcare Account Comparison

Fsa V Hra Tools To Manage Out Of Pocket Health Costs Schoolcare Nh Health Benefit Plans

Hsa Vs Fsa Which One Should You Get District Capital

Eligible Expenses Employee Benefits Corporation Third Party Benefits Administrator

Eligible Expenses For Hsas Fsas And Hras Rocky Mountain Health Plans Blog